Strategic planning is essential for guiding an organization's growth and long-term success. However, simply having a strategic plan is not enough - you need to be able to measure whether your strategic plan is achieving its intended goals and outcomes. This is where key performance indicators (KPIs) and key execution indicators (KEIs) become invaluable for tracking the effectiveness of strategic planning.

In this article, we will explore the top KPIs and KEIs to measure strategic planning success, best practices for tracking these metrics, and how to use these indicators for data-driven decision making.

Strategic planning KPIs, or key performance indicators, are quantifiable metrics that allow you to track progress towards strategic goals and objectives. Here are some of the most important KPIs to monitor:

Tracking overall revenue growth is essential for assessing progress towards strategic objectives focused on driving business expansion. Setting clear targets for total revenue increases allows you to evaluate commercial success and tie it back to the strategies outlined in your plan.

Additionally, monitoring revenue growth within key segments, product lines, or geographies defined as strategic priorities helps you determine whether these areas of focus are yielding their intended growth. For instance, if a strategic goal is to increase market penetration in a certain region, tracking revenue specifically from that region would be vital.

Gaining market share reflects how well your strategic efforts are positioning you to achieve competitive dominance. Your strategic plan likely outlines specific initiatives, like enhancing differentiation or targeting underserved segments, aimed at capturing share from rivals.

Tracking your overall share of important markets therefore signals whether these strategies are working. Gains indicate strategic success while declines suggest a disconnect between strategic aims around competition and actual implementation.

A lowering customer acquisition cost signifies that sales and marketing programs aligned to strategic goals are becoming more efficient at generating and converting leads. Since customer growth is fundamental for most strategies, the cost efficiency with which new customers are acquired through these investments is a key indicator of their ROI and alignment with long-term objectives.

Decreases in CAC also mean resources devoted to strategic lead generation and customer capture efforts are likely to yield better returns over time, paving success for future growth initiatives.

Customer satisfaction metrics provide vital insights into the effectiveness of strategies targeting enhanced customer experiences. As CX has become increasingly central to strategic planning, monitoring quantifiable satisfaction levels signals whether you are creating the kinds of compelling customer experiences outlined in your objectives.

Improvements indicate that investments in CX-focused strategic programs are paying dividends. Declines suggest more work may be required to align capabilities and culture with ambitions to provide a superior customer experience.

Continuously tracking these four vital KPIs provides quantifiable visibility into key aspects of your strategic plan’s effectiveness and alignment with ambitions around growth, competitive positioning, efficiencies, and customer experience. Together they form a balanced scorecard to measure strategic progress.

In contrast to KPIs, KEIs, or key execution indicators, track how well your strategy execution and implementation efforts are unfolding. Monitoring KEIs ensures strategic objectives translate into impact and outcomes.

Tracking the number and percentage of strategic projects and initiatives that have been fully implemented is a direct measure of execution progress. As part of the strategic planning process, organizations typically outline key projects, changes, and deliverables that support strategic goals. By quantifying how many of these have been completed on time, you gain visibility into real-world strategic follow-through.

This KEI indicates at a granular level whether your teams are operationally delivering on planned strategic commitments. Regularly assessing completion rates for strategic deliverables allows leadership to course-correct if execution is veering off track. Celebrating wins and milestones also reinforces strategic priorities.

Employees ultimately carry out the hard work of bringing strategy to life. Their energy and dedication determines the pace of progress. That's why monitoring engagement levels through periodic employee surveys provides invaluable intelligence on how your strategy rollout is landing in the organization. Look for survey feedback specifically related to understanding of and connection with strategic direction.

Positive scores indicate your leaders have effectively translated strategy into terms that motivate staff and align their efforts. Declining alignment, on the other hand, signals potential fragmentation or misinterpretation of strategic messaging. Addressing engagement issues promptly prevents culture becoming an obstacle to strategic success.

If new or enhanced products and services represent major planks of your strategic plan, analyzing usage data offers helpful context on how well these key outputs are penetrating your target customer segments. Metrics showing growing product or feature activation, online service subscriptions, ecommerce adoption, or digital channel migration demonstrate that your outputs are aligning tightly with evolving user needs.

Increased usage signifies that investments in strategic products and channels are succeeding in the market. Where usage stalls or declines, you may need to revisit product-market fit.

While metrics like revenue growth might represent longer-term indicators of strategy efficacy, improving NPS scores provides a more immediate perspective on how customer perceptions are shifting in response to your strategic pivots. Your NPS trajectory showcases whether the strategic moves you’re making - perhaps expanding channels, transitioning branding, or acquiring competitors - are winning over customers.

Prioritizing improvements in your NPS signals to employees and stakeholders that customer orientation remains at the heart of your strategic choices rather than being overshadowed by internal priorities. Your NPS therefore serves as a check that your strategy execution continues to keep customers’ best interests in mind.

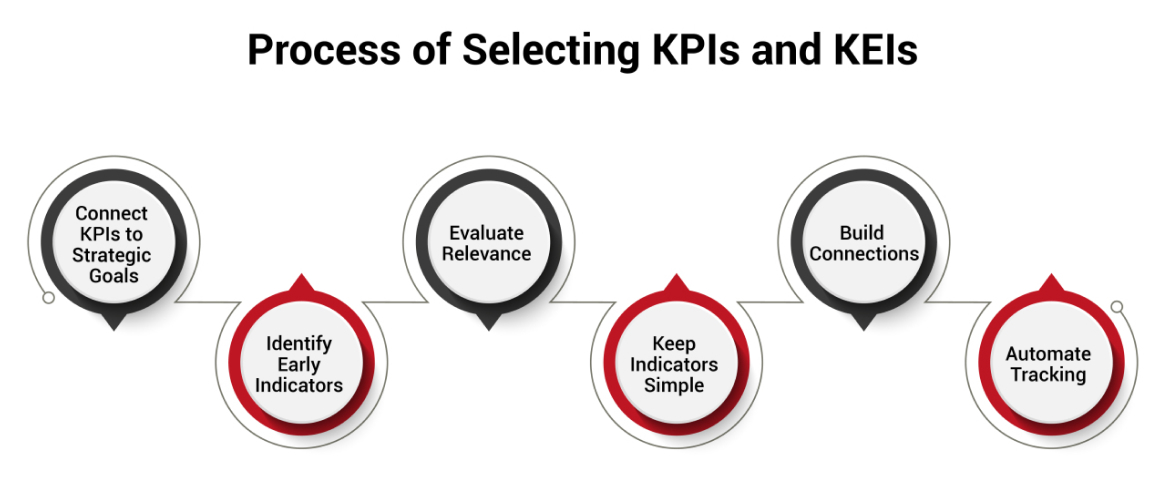

Choosing the right key performance indicators (KPIs) and key early indicators (KEIs) is vital for tracking strategic progress. Here is an overview of the process:

Begin by carefully mapping out which metrics have the strongest tie to each specific strategic goal or objective outlined in your plan. This linkage provides focus on only the most vital few KPIs.

For each KPI, determine what the early signals are that it is tracking in the right direction. These become your key early indicators. KEIs that can predict KPI outcomes allow for quicker responses to issues.

Assess the relevance of initial KPI and KEI selections at regular intervals. Business environments and strategic priorities shift, requiring metrics to be reevaluated and refreshed accordingly. Replace outdated indicators that no longer align.

Resist the urge to track too many metrics which leads to data overload. Adhere to the “less is more” philosophy by keeping indicators limited to the essential few tied to top priorities underlying each strategic goal.

Construct a tree map that visually depicts the cascade from overall strategy to goals to KPIs and KEIs. This outlines how each measure ladders up to provide insights into strategic effectiveness and facilitates communications.

Automating KPI and KEI tracking through digital dashboards and business intelligence systems increases efficiency while minimizing manual errors that undermine data reliability and decision making.

This process for selecting and managing key performance and early indicators significantly enhances your ability to monitor strategic plan progress and success over both long and short-term horizons. The result is enhanced agility and continuous alignment.

To maximize the impact of performance measurement on driving strategic success, continuously improving KPIs and KEIs through the following steps is essential:

As part of the strategic planning process , organizations should clearly define their key objectives for the next 2-3 years. These objectives should link directly back to the overarching strategic goals and vision.

For each defined objective, identify 2-5 relevant key performance indicators (KPIs) and key early indicators (KEIs) to track progress. These metrics must align to the specific activities and outcomes tied to each objective.

Educate employees on how their day-to-day work impacts the KPIs and KEIs mapped to strategic objectives. This builds organization-wide comprehension of the link between metrics and priorities.

Before implementing a strategic plan, quantify current levels for the most critical metrics. This may require compiling historical figures or doing specialized analyses to define baselines.

Baselines provide context for assessing progress towards targets as your strategy executes over 2-3 years. You can showcase momentum by reporting metric improvements as percentage gains over baselines.

Compare baselines for key metrics against industry benchmarks or leaders in your space. Major gaps indicate strategic priority areas for improvement.

Conduct market research and financial analyses to define what “best in class” looks like for your most crucial KPIs and KEIs. Use these insights to guide your target setting.

While targets should absolutely stretch the organization, they must also remain grounded. Balance ambition with pragmatic constraints around resources, capabilities, and past growth rates.

Set longer-term 5-year aspirational goals to complement 2-3 year targets. This blends visionary ambition with near-term execution.

Conduct regular quarterly business reviews focused specifically on KPI and KEI performance versus targets. Supplement with monthly monitoring of the most volatile or critical metrics.

Minimize manual tracking errors by displaying real-time metric dashboards powered by data integrations. Automate report generation and distribution.

Use meetings and internal communications to provide frequent visibility into metric improvements against targets across the organization and at team levels.

When metrics fall short of targets, lead root cause analyses to pinpoint strategic, operational, execution and resourcing gaps hindering progress.

Consistently high-performing areas may warrant additional funding, staffing and executive spotlighting. Underperformance signals reallocation needs.

If sustained underperformance indicates a strategic misalignment, have the courage to rapidly shift objectives and plans rather than persisting down an ineffective path.

Getting the most value from connecting metrics to strategic planning requires learning from the data to refine both planning and execution.

For example, if revenue growth KPIs significantly undershoot targets, this signals flaws in market assumptions, positioning, and sales/marketing elements of your plan. Reexamining customer research can unearth fresh perspectives to integrate into an updated strategic approach.

On the other hand, low employee engagement KEIs would prompt realigning corporate culture priorities featured in your strategy to match employee desires - the fuel for strategic success.

Tracking KPIs and KEIs leads to strategic learning - adjustments that can mean the difference between mediocre and standout strategic outcomes. Committing to data-inspired strategy iteration ensures your planning remains dynamic, differentiated, and focused on what matters most in driving your organization’s performance excellence.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.