TSI looks ahead to the next few years as the business world approaches what experts call an inflection point marked by the pandemic. A glance at what finance, energy, tech, healthcare, and consumer and retail will look like in 2025, and what these sectoral forecasts mean for the business strategy.

The internet industry will be surprising for an oil industry strategist. While things change quite a lot when they do, the events are mostly predictable in the oil industry – played out by the changes in geopolitical forces. On the other hand, changes and innovations happen at a breakneck speed in the internet industry; sometimes unforeseen and out of thin air.

Different industries demand different strategic approaches. Your agenda in the oil industry will be to defend your competitive position and maintain your unique capabilities since the entry barriers to new entrants are already very high. But as a business strategist working in the internet industry, your competitive advantage will come from keeping a pulse of the latest and responding to new trends faster than other players or potential entrants, and by continuing to evolve.

According to a study by the Harvard Business Review, companies, which align their business strategy with their industry environment tend to receive 4 to 8 percent higher returns than those who don’t.

Along with the talent and ability in classical and new business strategy frameworks, strategists need to inculcate a strong grasp on the industries they operate in, to effectively develop, deploy, and reinvent their stratagems.

As the pandemic accelerates change in nearly every industry (even oil indirectly), we take a stock of how major sectors are poised to shape up by the mid-2020s.

The infusion of technology is the source of disruption in the finance industry. Financial markets are unpredictable, and so are their fortunes. Artificial intelligence promises to bring some semblance of predictability and reliability to the finance industry.

By 2025, AI will reshape finance globally. Companies and regions that leverage it appropriately will dominate this sector.

AI will increase efficiency, speed, and customization. However, as it’s put into effect, it may also lead to the concentration of industry players due to relatively opaque algorithms.

Tech giants such as Amazon and Google are venturing into AI-based finance. Swarms of digital day traders have risen on Wall Street. Chinese companies are leading the AI cause in digital finance. The country is even planning to launch government-recognized digital currency: e-Yuan.

Which company or region wins the sector will also be influenced by the actions of regulators. By 2025, the vigilance around AI in finance will increase with regulators setting new benchmarks and policies.

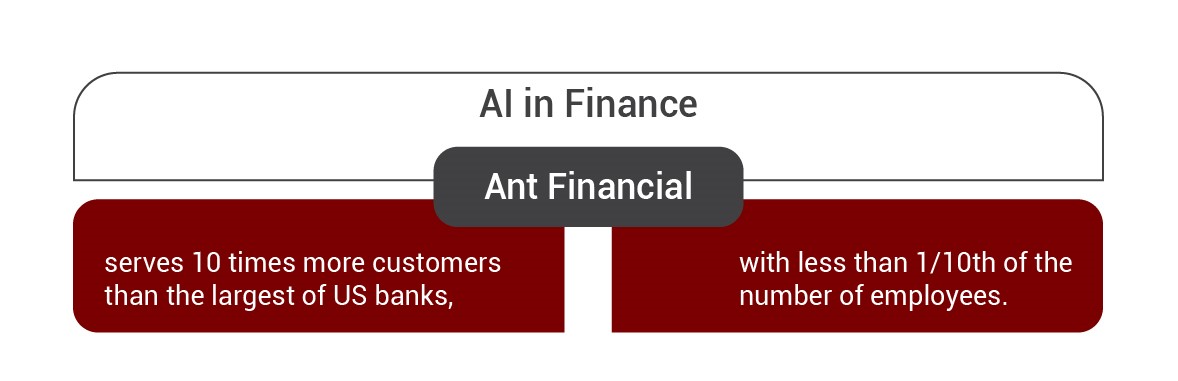

AI is no vaporware in the finance industry, and Ant Financial has proved it. Spun out of Alibaba, it uses data from its mobile platform: Alipay. Using this data and AI, it runs a variety of business units – from lending, wealth management, insurance, money market funds, etc.

Boom and bust cycles are century-old in the oil sector. It’s common knowledge that low prices today will lead to higher prices tomorrow. In 2020 the price of crude oil per barrel was treading downward, and it has risen by 133% since.

Going by the past trends of over 100 years, it could be said that by 2025 the oil prices will rise substantially. However, that is not so certain anymore. The never-changing energy sector is on the cusp of transformation – with the move toward decarbonization.

By 2025, some governments and companies will lead the new energy revolution – by achieving most of the targets to cut emissions – forcing a change in overall energy supply and demand.

In line with the 2030 agenda for sustainable goals, many governments have begun subsidizing and promoting efforts for electric vehicles and renewable energy sources. Some countries that have pledged to achieve net-zero greenhouse gas emissions include the US, EU, and Japan (by 2050), and China (by 2060).

According to International Energy Agency, realizing these low-carbon emission goals will need 20 times more growth in EVs and 100 times more supply of hydrogen.

For business strategists in the oil industry, used to perpetual growth, it is a cause for discomfort and the time for innovation. The bigger questions for them are: Who will provide these countries with the technologies required to achieve these targets? How will the biggest competitors in the oil industry react given they are in the business of a soon-to-be stranded asset?

According to the Market gurus, China will dominate the global energy market’s need by providing technologies that support decarbonization: wind turbines, electric vehicles, solar panels, among others. There are two major reasons behind this. Firstly, China is aggressively promoting renewable energy sources and industries with government programs. Secondly, rare earth minerals needed for these technologies, say minerals important to manufacture the magnet for the motor of wind turbines, are in China. The US companies will also compete fiercely in this race for tech dominance in the energy sector. By 2025, major players in the new energy market will emerge who would have gained a stronghold.

COVID-19 has accelerated change in the consumer and retail sector. The consumers were moving online even before the pandemic to cater to their shopping needs – from fast fashion to electronics and essentials. This pace has now been multiplied by several times.

By 2025, consumers will go online for every need. More businesses will provide remote buying options, and eCommerce services will become better, more convenient, and smarter.

Business strategists will need to continuously evolve online delivery services, and those at discount stores – even big ones like US’s Walmart – will come under pressure to innovate their business model.

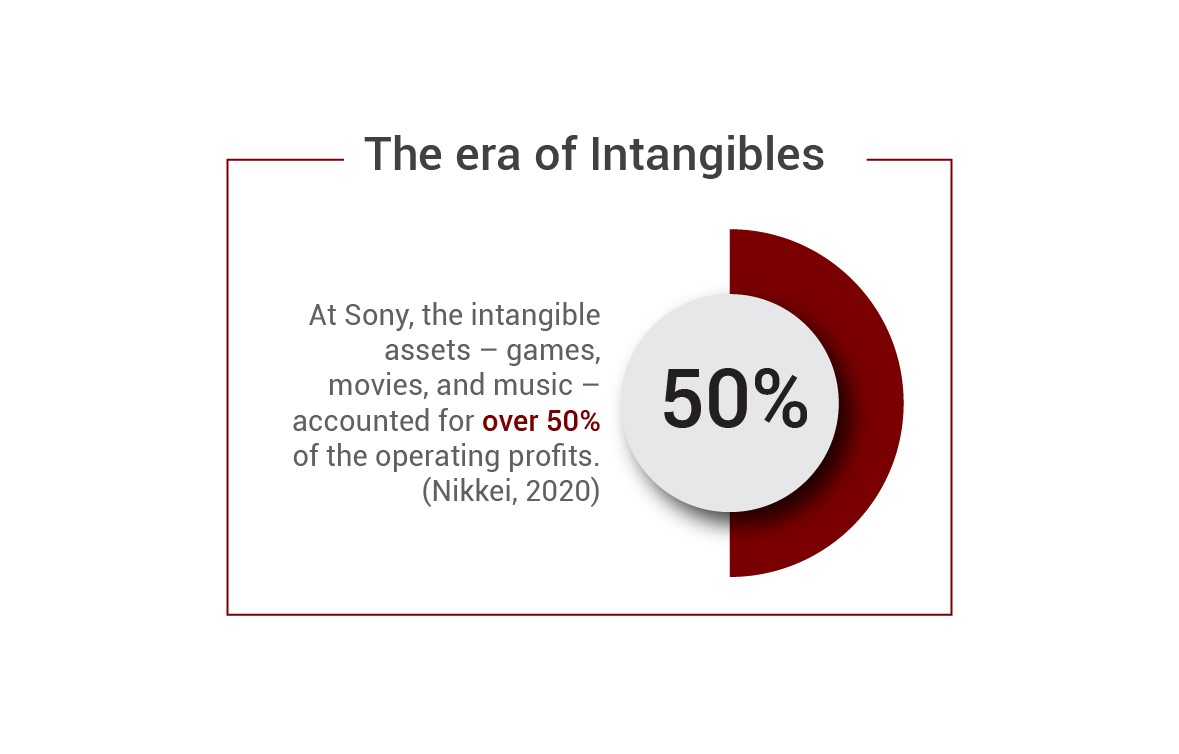

Along with virtual shopping and just-in-time logistics, businesses in the consumer and retail sector are showing another trend, i.e. ramping up on intangible assets such as trademarks, patents, and software. Intangibles are emerging as the new money-makers.

By 2025, competitive companies will invest more in the intangibles, with a ratio of tangible-intangible contribution reaching a balance of 1:1.

Two factors are leading this shift in strategy to intangibles: increased digitization, and the ease of acquiring scale. This trend will be the major differentiating factor for future business models.

Tesla’s EVs are known for their better performance software – instead of hardware. Toyota has launched a “software-first” management model. Facebook, Apple, Amazon, Netflix, and Google (FAANG) are where they are because of their intellectual property software. Sony in Japan has reduced its plants and tangible assets to bring hardware-software revenue ratio to 1:1 in March 2020. It expects the contribution of hardware to further decrease by 2025.

Digital services providers have gotten a strong lift after the pandemic. What’s more surprising is the crisis has led to the dilution of the power of some of the Tech Giants.

For instance, Zoom was one of the small market players, which rose to prominence and became an eponym for video conferencing and communication during the pandemic – both for business and individual clients.

The trend is being proliferated both by external players (like Zoom), and internally by the Big Tech itself; Google and Amazon are trying to spin off their cloud computing business unit to new companies. Besides, the cream of engineering talent from tech giants is feeding this shift.

By 2025, more digital champions will emerge leading a new generation of tech companies. However, a digital oligopoly with ‘a few winners takes most’ dynamics will prevail.

There is a second change underway in the hiring at tech companies. As IT penetrates different diverse businesses and industries, the technology sector will actively hire specialists with know-how of specific industries. The question of technology ethics will gain prominence, and specialists will be the key to this puzzle. Amazon and Microsoft are already hiring industry experts.

After taking a defeat from WeWork real-estate investment, SoftBank’s CEO, Masayoshi Son is venturing into new areas and putting money wherever AI technology is expected to make a mark – such as healthcare, and others. He says, his is now a company investing not in industries or sectors, but in the AI revolution.

About another trend, Karen DeSalvo, a high-ranking official at the US department of health recently joined Google as a specialist to help it penetrate the healthcare industry. DeSalvo said, Google must bring talent from the medical field, so they are able to venture in the industry with sound policies in line with the regulations. This will ensure they are ‘doing the right thing’ for the consumer.

The biggest sectoral impact of the pandemic has been on healthcare, not just owing to the volume and scale of the epidemic, but also the range of innovations, and the emergence of new players seen since 2020.

Bigger changes are expected in healthcare that will be led by technology, such as internet of medical things (IoMT). IoMT devices are fusing sensors with medical data to allow patients to self-monitor. Telemedicine and tele-advisory by doctors are other rising tech trends. The tech in healthcare is currently worth USD 81 billion (CB Insights).

By 2025, telehealth services will gain more traction. From diagnosis and monitoring to mental health and advisory, technology will cover a lot of bases in healthcare.

There are twofold factors for this rise: a lack of access to the physical healthcare spaces due to the pandemic and shedding of patients’ and doctors’ inhibitions toward online advising and services.

Business strategists in care economy will need to reimagine the role of healthcare personnel and consider a hybrid way of providing services. Intervention by medical regulators may also shift balances in the healthcare technology market in the next few years. Going forward, the focus on mental health will also increase with increased social isolation due to digital and pandemic effects.

The increased role of the tech industry in healthcare, and lowering barriers to their entry is evident from the US’s Food and Drugs Administration (FDA) and the Health Insurance Portability and Accountability Act (HIPAA) relaxing the restrictions on virtual doctor visits and allowing tech companies to pitch their remote patient monitoring devices to the hospitals. As a result, many new telehealth players have emerged.

Furthermore, Google and Apple, in April 2020, together launched a contact tracing app to limit the spread of COVID-19 infection. Albeit, they had to bring tweaks to the app after concerns were raised on user data security.

When asked to imagine life in 2025, a group of 915 innovators, business strategists, and policy leaders extended their viewpoints. Whether positive or negative, their broad assessment was a continuing deepening effect of technology on every sector – healthcare, work, education, and more.

A few technologies that experts think will become a part of our everyday lives by 2025:

A few developments and technologies forecasted to change how we live in future decades:

Source: Pew Research 2021

As twin engines of digitization and automation impact across sectors, one thing is clear: our technologies are surpassing the stage of simple disruption. Digital innovation in the 2020s will raise better opportunities and deeper concerns for the strategists and executives.

As these trends are amplified by the crisis, are you ready to lead your industry with the approach it needs for this decade?

The new business ecosystem requires climbing the ladder to high-level strategy skillsets. Gain the proficiency and confidence to lead the tele-world with business strategy certifications from The Strategy Institute (TSI) meditated by the futurists and industry experts.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.