As a business strategist, consultant, manager, executive, or leader, you are always on the lookout for ways to improve your organization’s performance. One way to achieve that is by creating and executing an impactful business strategy.

Strategy as a field of study is very nascent in business studies. Though an old military concept, and on occasions referred to in politics and foreign diplomacy, a strategy wasn’t so native to the business world, until recently. Michael Porter, the management guru’s seminal paper on “How Competitive Forces Shape Strategy” (1979) changed that for good.

Since Porter’s Five-Forces Model, many strategic frameworks have emerged in business. Some stayed and others strayed away. We discuss here the ones that have dwelled on and made a huge difference for businesses.

These time-endured business methods will add to your toolkit and give you a strong understanding to formulate and execute better business strategies. Choose a strategy framework that best fits your business needs.

Developed by McKinsey & Company

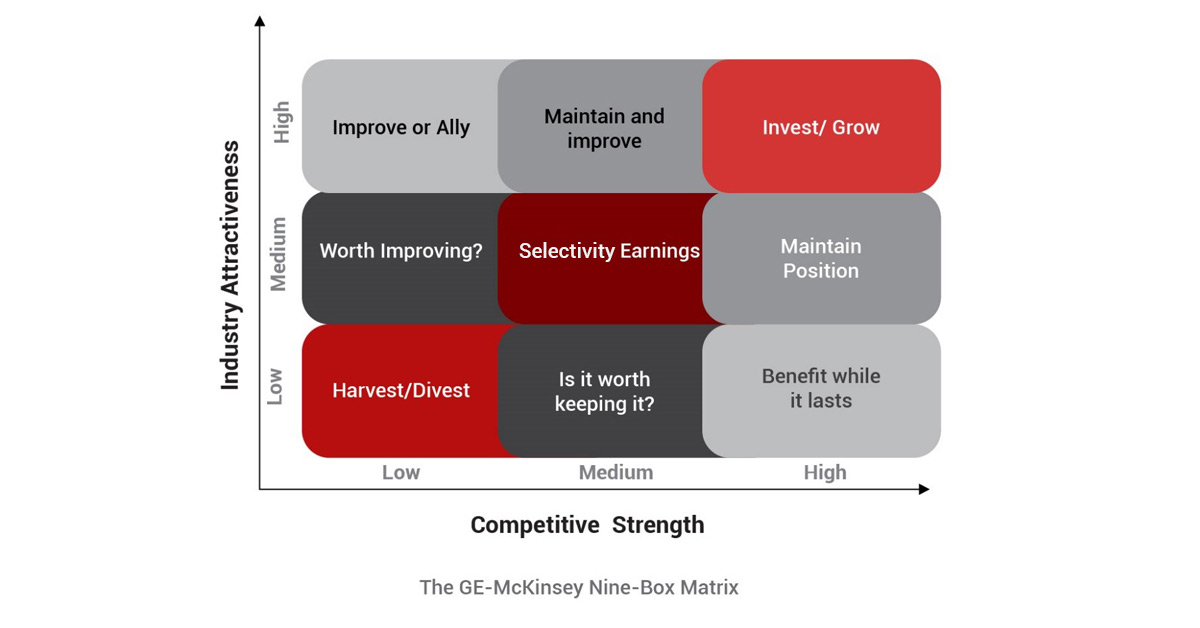

Multi-business firms manage numerous business portfolios, sometimes ranging from 50 to 100 products and services. The breadth of these operations makes it very hard to decide on what to invest in and what to let go of given limited resources. The GE-McKinsey Nine-box matrix was developed to help companies make these decisions easier.

Goal: To prioritize investments in numerous business units.

Origins: In the 1970s, GE managed complex business portfolios comprising unrelatedproducts and services. Until then they relied on future cash flow projections, marketgrowth, and more to make investment decisions. Unsatisfied with the returns oninvestments, GE consulted with McKinsey and consequently, the Nine-Box StrategyFramework was born.

How it works?

In the 9-box matrix, opportunities are categorized as high, medium, and low on two axes of industry attractiveness and competitive strength.

Competitive strength is an internal variable that’s assessed by estimating market share, profitability, and brand perception of the product. Industry attractiveness is an external variable, which is assessed by estimating the rate of growth in the industry in question, the number of competitors, barriers to entry, and the industry’s profitability.

Used to:

Takeaway: Knowing when to retreat is much more important than basking in success.

Case Study: Why discontinuing Zune was an intelligent decision for Microsoft?

This case best represents the “divest/harvest” scenario (bottom-left corner) of the GE-McKinsey matrix.

In the early 2000s, every tech company boasted of its mp3 player. At the time when Apple became synonymous with the iPod, Microsoft launched its mp3 player called Zune in 2006.

To the dismay of the mp3 player market, Apple introduced the iPhone a year later.

Mp3 players were fated to end in the emerging smartphone market.

It was then Microsoft decided not to further invest in Zune and discontinue it in 2008, only two years after its launch. This was an intelligent and timely decision given Zune was a new entrant and wasn’t a strong player yet in the market, and the mp3 player market was soon to become unviable.

Developed by the Boston Consulting Group (BCG)

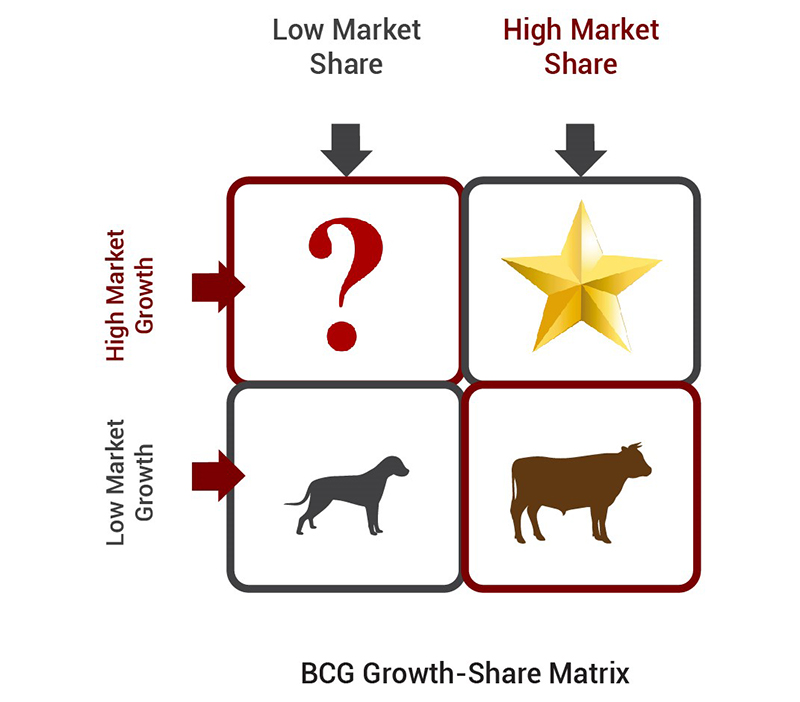

The BCG strategy matrix classifies products based on their growth potential. It’s a passive approach that determines what you should expect from a product.

Goal: To assess the relative strength of different product lines by profitability.

Origins: This is the first-ever portfolio management framework designed to prioritize investments for multi-business corporations. Created in 1968 by BCG founder, Bruce Henderson, in its prime, it was used by over half of Fortune 500 companies.

How it works?

In the growth-share matrix, products are categorized based on the “market share” of the product and overall “market growth.” Along these two axes, product lines are assigned to one of the 4 quadrants – Star, Cow, Question mark, and Dog. A star product has a high market share, and its market grows at high rates.

Market growth in the matrix is always relative and is considered about the economic growth rate. If the economy grows at 6%, and a market by 4%, we can conclude the market growth is low.

Used to:

Takeaway: If you have a star product, don’t rush to release new versions.

Case Study: How Windows made Microsoft the software emperor?

Microsoft was already ruling the software market in the 80s and 90s. These were the times when the software industry was evolving at record rates. A computer purchased in January with new software would become obsolete before July.

MS-DOS of Microsoft was the most prevalent software of all.

In 1985, Microsoft launched the first Windows as a virtual simulation. It was easier to use and appealing to the eye. Windows increased the market share of Microsoft by 90%, and it about maintains its position till date.

While MS-DOS was dominant in the market, Microsoft speculated its fall and released “only” a virtual simulation of MS-DOS in the form of Windows, which gave Microsoft its star product. However, now sometimes their developers tend to bring newer versions without realizing the user’s comfort with existing environments (classic case of fearing your star product will lose the market).

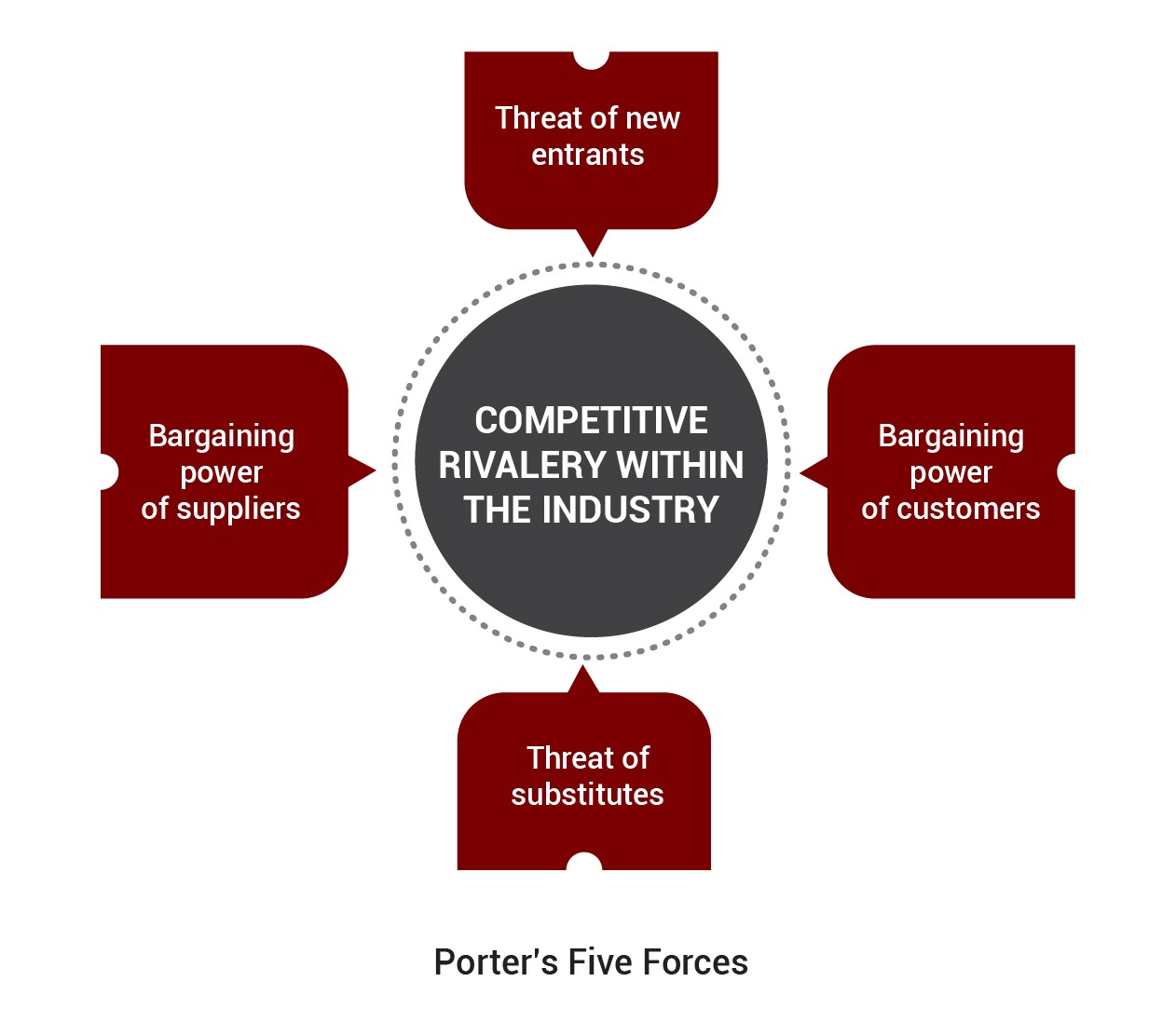

Developed by Michael E. Porter

Porter’s five forces shape every industry and market. They are an analysis tool to assess any market and determine the competition therein, and hence its profitability and attractiveness. It can be employed as a sub-part of other strategy frameworks to analyze the market you plan to enter or are already in.

Goal: To determine market viability

Origins: Harvard Business School professor, Michael E. Porter, developed the Five Forces Model in 1979. He postulated that industry structure triumphs individual firm behavior in determining success for an organization. The model has found widespread usage among firms to analyze external forces such as government policies, culture, competition, and more.

How it works?

The model outlines the five factors influencing profitability in a market. They are competitor rivalry, bargaining power of buyers, bargaining power of suppliers, threat of new entrants, and threat of substitute offerings.

A business strategist must ask each of these drivers the force they wield in the market. For instance, in the case of suppliers, how many suppliers are there, how difficult it is to negotiate with them, can you substitute suppliers, etc.

Used to:

Takeaway: Sometimes it’s better to have a mediocre product in a perfect market than a perfect product in the wrong market.

Case Study: How Jeff Bezos monopolized e-commerce with Amazon?

An extensive market analysis, done right, can place you among the top richest people. Ask Jeff Bezos.

He created Amazon and monopolized e-commerce without even being from the sector or born with a silver spoon. He worked for a hedge fund for years before creating Amazon.

After analyzing the e-commerce market in-depth in the 1990s, he discovered an unexplored niche in books and ventured right into it. He started Amazon as an online book sub-market that today has grown across all industries and sectors.

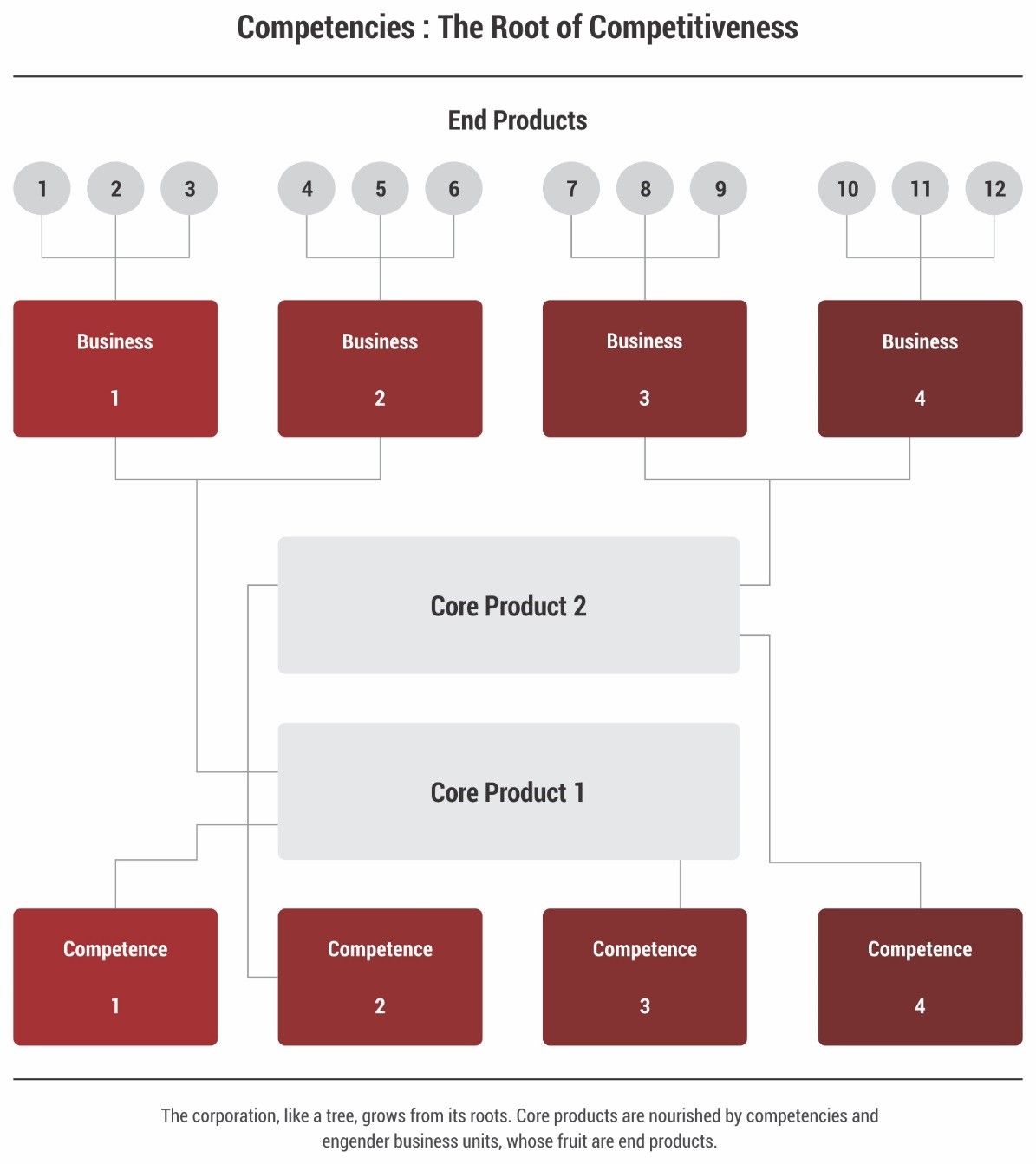

Redefined by Bain & Company

Core Competency Model Diagram by Prahalad and Hamel

The core competency framework helps companies find their deep proficiency and unique value propositions. It screens through the company’s collective learning and figures out the best way to improve core competency via better coordination across diverse production units, and multiple technologies.

Goal: To identify areas of deep proficiency that are hard for competitors to copy or procure

Origins: Many organizations and scholars have contributed to the development of this framework. The earliest ones were CK Prahalad, a professor of corporate strategy at the University of Michigan, and Gary Hamel, a lecturer at London Business School. It has been further refined by Bain and Company, and adopted in several industries including electronics, automotive, and others.

How it works?

According to Bain & Company, the litmus test of a Core Competency is whether it should be hard for competitors to copy or procure. To achieve that, isolate key abilities, compare them with others, understand what customers want, create a roadmap to hone and sustain them, and finally outsource/divest non-core capabilities.

Used to:

Takeaway: Investing in strengths is always better than correcting weaknesses.

Case Study: How Southwest Airlines created a unique company culture?

Being competitive has its roots in identifying your competencies. To outrank existing players in the market, Southwest Airlines undertook an activity to do just that. Results? They became an A-grade customer service provider and reduced plane turnaround time.

How did they achieve that?

To develop the right strategy based on its core competencies, Southwest Airlines first surveyed passengers, shareholders, and employees to understand what their desired outcomes are from any improvement drive at Southwest. Minimizing costs, and on-time departures, for instance, were some of the ideal outcomes for the passengers.

These responses then were ranked and analyzed from those of competitors. Based on that, business analysts at Southwest Airlines determined the level of performance they should target for selected outcomes, which were at cross-interaction of all three stakeholders. The targets were set based on the organization's core strengths and that lacking in the competitors.

Developed by Robert Kaplan

Balanced Scorecard

It is used by businesses to take a top-level view of how they are doing. Over time it has become a widely used strategic tool in management.

Goal: Track company performance.

Origins: Harvard University professors, Robert Kaplan, and David Norton developed balanced scorecard model in 1992 to measure organizational performance. Initially, it was used only as a measure of short-term financial performance.

How it works?

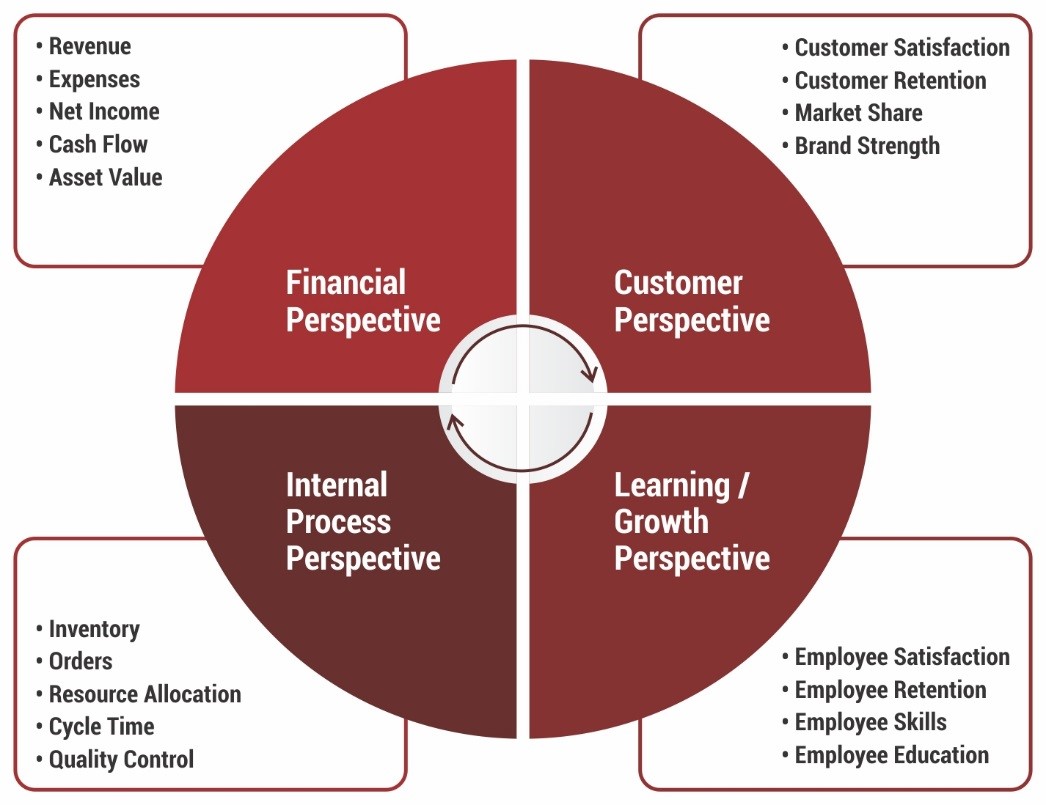

Balance scorecard studies performance indicators typically grouped into four perspectives – financial, customer, process, and innovation.

Different indicators can be used based on the type of business. For instance, a restaurant will have different factors of success than an automotive company. The KPIs under these factors are usually compared with pre-determined objectives.

Used to:

Takeaway: Converting intangibles into tangibles makes assessment so much easier.

Case Study: How Zoom did during the coronavirus?

During the coronavirus pandemic, Zoom was in direct competition with Skype, and it has been trying to replace Skype by upping its market share as the go-to videoconferencing application. Did you know its growth was plateauing before the pandemic? However, since 2020 the company has been prolifically growing its user base.

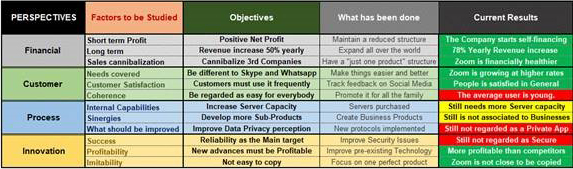

If we were to understand how Zoom is currently doing, its balanced scorecard may look something like this:

Source: Consuunt

Based on the status, we can conclude that financially it is doing well— its revenue increased by a margin of nearly 7.5 percent in their fiscal year 2023— compared to the fiscal year 2022, and its customer base is also growing at high rates. However, since it wants to find an audience among all age groups, it should formulate strategies around that. From an innovation perspective, it is working well with enterprise and premium models, although security remains to be an issue.

While the need for skilled business strategists is growing. According to LinkedIn, in the landscape of 2024, strategic advisors navigate a complex array of challenges, with their roles evolving at an unprecedented pace. The rapid acceleration of change, exemplified by a notable 33% increase in the past year, has broadened the strategic advisor's responsibilities. They are now required to possess a nuanced comprehension not only of markets and economies but also of geopolitics, climate change, and broader societal impacts.

What professionals need to make an informed assessment of business position, pricing, and product-market fit is a knowledge of the right tools. Delving into strategy frameworks can take them close to their goals, and will help them:

Master strategizing today! Learn to use the most practiced management tools and frameworks with the business strategy certifications of The Strategy Institute. To know more about what TSI can offer you, visit us.

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.